Page 88 - SHELTER

P. 88

CASE STUDIES

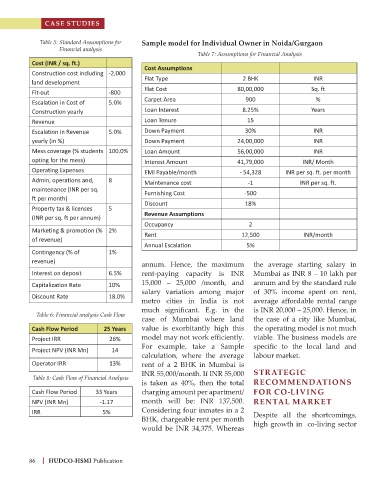

Table 5: Standard Assumptions for Sample model for Individual Owner in Noida/Gurgaon

Financial analysis

Table 7: Assumptions for Financial Analysis

Cost (INR / sq. ft.) Cost Assumptions

Construction cost including -2,000

land development Flat Type 2 BHK INR

Fit-out -800 Flat Cost 80,00,000 Sq. ft

Escalation in Cost of 5.0% Carpet Area 900 %

Construction yearly Loan Interest 8.25% Years

Revenue Loan Tenure 15

Escalation in Revenue 5.0% Down Payment 30% INR

yearly (in %) Down Payment 24,00,000 INR

Mess coverage (% students 100.0% Loan Amount 56,00,000 INR

opting for the mess) Interest Amount 41,79,000 INR/ Month

Operating Expenses EMI Payable/month - 54,328 INR per sq. ft. per month

Admin, operations and, 8 Maintenance cost -1 INR per sq. ft.

maintenance (INR per sq. Furnishing Cost -500

ft per month)

Discount 18%

Property tax & licenses 5

(INR per sq. ft per annum) Revenue Assumptions

Occupancy 2

Marketing & promotion (% 2% Rent 12,500 INR/month

of revenue)

Annual Escalation 5%

Contingency (% of 1%

revenue) annum. Hence, the maximum the average starting salary in

Interest on deposit 6.5% rent-paying capacity is INR Mumbai as INR 8 – 10 lakh per

Capitalization Rate 10% 15,000 – 25,000 /month, and annum and by the standard rule

salary variation among major of 30% income spent on rent,

Discount Rate 18.0%

metro cities in India is not average affordable rental range

much significant. E.g. in the is INR 20,000 – 25,000. Hence, in

Table 6: Financial analysis Cash Flow

case of Mumbai where land the case of a city like Mumbai,

Cash Flow Period 25 Years value is exorbitantly high this the operating model is not much

Project IRR 26% model may not work efficiently. viable. The business models are

For example, take a Sample specific to the local land and

Project NPV (INR Mn) 14

calculation, where the average labour market.

Operator IRR 13% rent of a 2 BHK in Mumbai is

INR 55,000/month. If INR 55,000 STRATEGIC

Table 8: Cash Flow of Financial Analysis

is taken as 40%, then the total RECOMMENDATIONS

Cash Flow Period 33 Years charging amount per apartment/ FOR CO-LIVING

NPV (INR Mn) -1.17 month will be: INR 137,500. RENTAL MARKET

IRR 5% Considering four inmates in a 2 Despite all the shortcomings,

BHK, chargeable rent per month high growth in co-living sector

would be INR 34,375. Whereas

86 HUDCO-HSMI Publication